Ultimate Overview to Comprehending Corporate Volunteer Agreements and Just How They Profit Services

Business Voluntary Agreements (CVAs) have ended up being a critical tool for organizations looking to navigate monetary challenges and restructure their procedures. As the organization landscape proceeds to advance, understanding the complexities of CVAs and how they can positively impact firms is essential for informed decision-making.

Understanding Corporate Volunteer Arrangements

In the realm of business administration, a fundamental idea that plays a pivotal function fit the partnership between stakeholders and companies is the complex device of Company Voluntary Contracts. These agreements are volunteer dedications made by business to stick to specific standards, techniques, or objectives past what is lawfully called for. By becoming part of Business Voluntary Contracts, firms show their dedication to social obligation, sustainability, and moral service practices.

Benefits of Company Voluntary Arrangements

Relocating from an exploration of Corporate Voluntary Contracts' importance, we now transform our focus to the substantial advantages these agreements use to companies and their stakeholders. Among the key advantages of Business Volunteer Contracts is the chance for firms to restructure their financial debts in an extra convenient way. This can aid relieve economic burdens and prevent potential bankruptcy, permitting the business to proceed operating and potentially grow. In addition, these contracts give an organized framework for arrangements with creditors, fostering open interaction and collaboration to reach mutually valuable options.

Additionally, Company Volunteer Agreements can enhance the business's online reputation and connections with stakeholders by demonstrating a dedication to resolving economic challenges sensibly. By proactively looking for solutions through voluntary contracts, businesses can showcase their devotion to maintaining and fulfilling obligations trust fund within the industry. Furthermore, these contracts can use a degree of discretion, allowing firms to resolve monetary difficulties without the general public scrutiny that might go along with other restructuring options. On The Whole, Corporate Voluntary Agreements function as a calculated tool for firms to navigate financial difficulties while maintaining their partnerships and procedures.

Refine of Executing CVAs

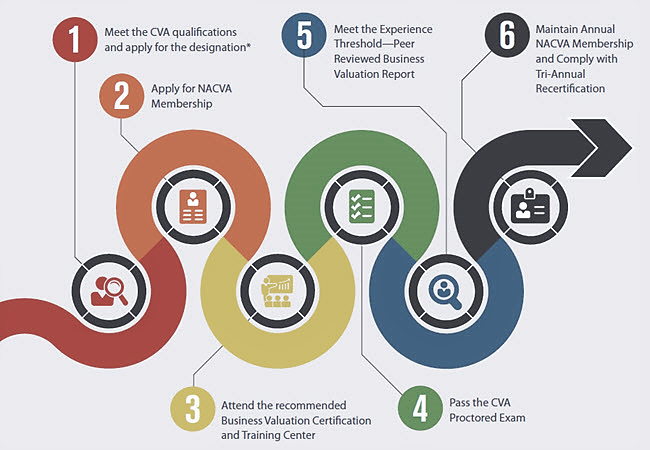

Recognizing the procedure of carrying out Corporate Voluntary Agreements is vital for firms looking for to navigate financial difficulties successfully and sustainably. The first step in executing a CVA involves selecting a licensed insolvency professional that will certainly work carefully with the business to evaluate its economic scenario and feasibility. This first assessment is crucial in determining whether a CVA is the most suitable solution for the business's economic difficulties. As soon as the decision to wage a CVA is made, a proposal outlining exactly how the business intends to settle its financial institutions is composed. This proposition needs to be authorized by the business's lenders, that will certainly elect on its acceptance. If the proposition is approved, the CVA is implemented, and the company must abide by the agreed-upon settlement strategy. Throughout the application process, regular interaction with financial institutions and attentive economic administration are crucial to the effective implementation of the CVA and the business's eventual monetary recovery.

Key Considerations for Businesses

When evaluating Company Voluntary Agreements, organizations have to very carefully think about essential elements to ensure successful financial restructuring. One critical factor to consider is the sustainability of the recommended settlement strategy. It is important for services to examine their capital forecasts and make sure that they can fulfill the agreed-upon repayments without endangering their procedures. Additionally, services should thoroughly examine their existing debt structure and review the effect of the CVA on various stakeholders, including suppliers, financial institutions, and workers.

One more important consideration is the degree of transparency and communication throughout the CVA procedure. Open up and truthful interaction with all stakeholders is essential for building count on and making certain a smooth implementation of the contract. Services should likewise consider seeking expert recommendations from economic consultants or legal experts to navigate the complexities of the CVA process efficiently.

Additionally, services need to evaluate the long-lasting ramifications of the CVA on their online reputation and future funding opportunities. While a CVA can provide immediate relief, it is important to examine just how it might influence partnerships with lenders and investors in the lengthy run. By very carefully considering these vital elements, services can make informed decisions regarding Company Volunteer Contracts and establish themselves up for an effective economic turn-around.

Success Stories of CVAs in Activity

Several organizations have effectively applied Corporate Voluntary Contracts, showcasing the performance of this financial restructuring tool in rejuvenating their procedures. One remarkable success tale is that of Business X, a struggling retail chain dealing with personal bankruptcy due to mounting financial debts and decreasing sales. By participating in a CVA, Business X was able to renegotiate lease arrangements with property owners, minimize expenses expenses, and restructure its debt obligations. As an outcome, the business was able to maintain its financial setting, enhance cash flow, and prevent bankruptcy.

In one more instance, Company Y, a production firm strained with tradition pension plan obligations, made use of a CVA to rearrange its pension obligations and simplify its procedures. Through the CVA process, Business Y attained considerable cost savings, improved its competition, and safeguarded long-term sustainability.

These success tales highlight how Corporate Volunteer Agreements can give struggling businesses with a sensible course in the direction of financial healing and operational turnaround - what is a cva agreement?. By proactively resolving economic challenges and restructuring obligations, companies can emerge stronger, more nimble, and better placed for future development

Verdict

In conclusion, Business Volunteer Agreements offer businesses a structured technique to resolving financial troubles and restructuring debts. By executing CVAs, business can stay clear of bankruptcy, safeguard their possessions, and preserve connections with creditors.

In the realm of corporate administration, an essential idea that plays a critical function in forming the connection between business and stakeholders is the complex system of Business Volunteer Agreements. By getting in right into Corporate Voluntary Arrangements, business demonstrate their dedication to social responsibility, sustainability, and moral company methods.

Moving from an expedition of Business Voluntary Arrangements' significance, we now turn our focus to the tangible benefits these contracts provide to companies and their stakeholders.Moreover, Company Voluntary Contracts can improve the business's online reputation and partnerships with stakeholders by showing a dedication to dealing with monetary what is a cva agreement? challenges responsibly.Comprehending the process of implementing Business Volunteer Agreements is essential for companies seeking to navigate economic difficulties properly and sustainably.

Comments on “Comprehending Corporate Voluntary Agreement: CVA Meaning in Business”